Managing your finances correctly is critical in the present rapidly-paced planet, and Using the rise of technological know-how, different instruments are offered to aid people today in budgeting and tracking expenditures. The top budgeting application can simplify your economical administration, allowing for you to keep up Regulate more than your investing and price savings. Quite a few buyers request a absolutely free spending budget application to begin their journey with no Preliminary investment. Luckily, you'll find various cost-free budgeting applications that cater to various wants, helping you take care of your cash without additional expenditures.

For all those trying to find an application specially made for budgeting, a lot of alternatives exist which offer consumer-pleasant interfaces and necessary features. When hunting for totally free budgeting software, it’s essential to think about what functionalities are most useful for your personal money predicament. The top budgeting software program will supply a comprehensive overview of one's funds, enabling you to trace investing behavior and identify places for advancement. Partners, particularly, might benefit from utilizing the ideal budgeting application for couples, as these tools often incorporate characteristics built to boost joint economical management, ensuring that the two associates are on the same website page concerning their finances.

In the event you’re looking for a absolutely free budgeting application for partners, lots of alternatives enable the two people to lead to the exact same fiscal plan, facilitating improved conversation and collaboration in revenue administration. Utilizing a spending budget tracker application may help you visualize your bills and income, making it much easier to detect traits and areas in which you can Reduce back again. Budget tracking applications supply insights into your paying out patterns, rendering it simpler to adhere to the spending plan and attain your financial aims.

For individuals keen on broader fiscal management, an application for money administration can encompass An array of tools, from expenditure tracking to investment monitoring. A cash administration application can help you keep the fiscal lifestyle arranged, guaranteeing you will be aware about in which your hard earned money goes on a monthly basis. Several buyers notice that the most beneficial own finance app supplies not simply budgeting capabilities but in addition integrates attributes for instance investment tracking, retirement arranging, and cost categorization, which makes it a holistic Answer for taking care of funds.

A bill tracker app is A necessary Resource for anyone who wants to stay in addition to their recurring fees. Invoice monitoring apps assist you to check because of dates and payment amounts, blocking late costs and supporting you manage a beneficial credit score rating. By managing your charges properly through a devoted app, it is possible to ensure that you never ever miss a payment and keep fiscally responsible.

For all those just commencing their budgeting journey, the principles of cash administration could be clear-cut but transformative. Being familiar with the basics may lead to substantial improvements as part of your fiscal problem. Many of us notice that Finding out about funds administration might be pleasurable and satisfying. When you come to be more acquainted along with your funds, you are going to discover approaches to make your cash work more difficult for you.

The vital things of productive dollars management contain setting distinct ambitions, tracking your income and expenses, and examining your monetary situation routinely. These tactics will help you create a solid Basis for monetary steadiness. Embracing budgeting and tracking your funds can change into an enjoyable and fascinating action rather then a laborous chore.

It is important to acknowledge that powerful cash administration needs ongoing exertion and adaptability. As your fiscal problem variations, so much too really should your method of budgeting. By remaining adaptable and open up to adjusting your methods, it is possible to better respond to new problems and options that arise.

When you delve deeper into the globe of non-public finance, you will uncover various techniques that will simplify your economic administration. Utilizing know-how, including cellular applications created for budgeting, can improve your capacity to keep organized and educated about your finances. These instruments can function secret weapons as part of your journey towards economic literacy and obligation.

The cash administration landscape is regularly evolving, and it’s essential to continue to be informed about the most recent traits and resources available. Familiarizing on your own with rising systems and innovative programs can offer you useful insights that boost your economic administration methods.

Comprehending that money administration is surely an ongoing course of action can empower you to create informed decisions. By actively partaking along with your finances, you may take demand within your economic long term and established you up for fulfillment. No matter if you like a spending plan tracker application or a far more extensive cash management Option, The real key is to locate the proper tools that align with the Way of life and economic objectives.

Evaluate the part of money management in your lifestyle, and replicate around the approaches it may possibly increase your In general financial nicely-currently being. By taking the time to explore different budgeting strategies and applications, you may find tactics that resonate along with you and result in Long lasting money wellbeing.

In terms of budgeting, you'll find various ideas and tricks to remember. A person effective strategy is usually to regularly evaluate your economical predicament and adjust your funds appropriately. This observe will help you continue to be aligned using your goals and makes sure that you remain proactive with your economical preparing. You may also discover it valuable to categorize your expenditures to better recognize in which your cash is going and detect regions in which you can Lower back.

Making use of options from a private finance application can streamline this method, permitting you to watch your development and make knowledge-pushed selections. Lots of end users realize that adopting a structured method of budgeting can cause additional disciplined expending and improved financial savings practices.

As you examine the entire world of cash management, you could possibly come across several methods that supply beneficial insights and information. From content articles to films, the wealth of information offered can provide you with new Thoughts and procedures for managing your funds. Partaking Using these means can encourage you to definitely just money management app take control of your economic journey.

While you learn more about budgeting and monetary management, take into account sharing your ordeals with Some others. Whether or not it’s speaking about your journey with close friends or taking part in on line boards, connecting with Other people can offer you assist and determination as you work towards your economic targets.

In the long run, the journey to helpful revenue administration starts by using a commitment to knowing your funds and having actionable ways towards improvement. By leveraging the right tools and adopting a proactive mindset, you could develop a sustainable budgeting program that supports your monetary aspirations. Understand that each and every little action counts, and after a while, your endeavours will contribute to your safer and prosperous economic upcoming.

In conclusion, the best budgeting app can appreciably boost your capability to deal with your funds, regardless if you are employing a totally free finances app, a bill monitoring application, or an extensive individual finance app. The key is to discover the appropriate applications and procedures that work for you. By finding the time to take a look at your choices and decide to your economic journey, it is possible to build strong cash management habits that may serve you perfectly For a long time to return. With persistence and the correct means at your disposal, attaining your financial targets is nearby.

Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Andrea Barber Then & Now!

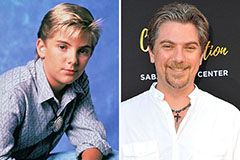

Andrea Barber Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!